Introduction: When Doing the Right Thing Becomes Unaffordable

This article is part of the “Robbed in Plain Sight” series.

See the full series here: Robbed in Plain Sight!

We often say we value family.

We praise adult children who care for aging parents. We speak warmly about honoring mothers and fathers in their final years. We talk about dignity, stability, and staying rooted in community.

But when caregiving intersects with bureaucracy, those values can disappear quickly.

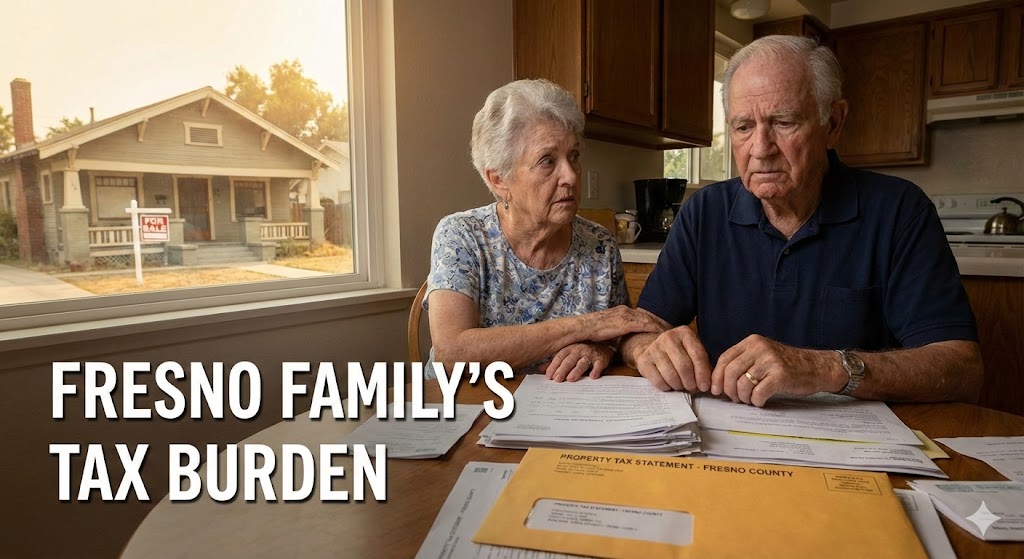

This article is about what happened after my father died—and how a system that claims to support families instead made staying in our family home financially impossible.

A Promise Made Long Before the Crisis

Years before my father’s death, my parents did what responsible people are encouraged to do.

They hired an attorney.

They planned ahead.

They placed the family home into a trust so it could pass to their children smoothly after they were gone.

The goal was simple:

- stability

- continuity

- avoiding unnecessary disruption during grief

The home was modest—about 1,500 square feet—and had been in our family since before I was born. It was not an investment vehicle. It was a place of memory, care, and continuity.

Caregiving Without a Safety Net

As my father’s health declined, my wife, son, and I structured our lives around his needs.

We stayed in Fresno.

We were available around the clock.

We limited church attendance, travel, and ordinary family activities because paid caregivers often failed to show up—especially on Sundays.

This was not martyrdom.

It was responsibility.

My father wanted to remain in his home, and we honored that wish.

What Changed After Death

After my father passed away, I bought my sister’s half of the house so the home could remain intact.

That single act triggered a reassessment.

Suddenly:

- property taxes increased dramatically

- monthly payments rose by roughly $1,600

- the increase was retroactively imposed through my mortgage company

There was no gradual transition.

No recognition of hardship.

No accommodation for the fact that I was nearing retirement age.

The message was blunt:

Pay—or lose the home.

Paperwork as a Barrier, Not a Path

There were forms.

There were explanations.

There were references to exemptions and hardship provisions.

But accessing them required:

- legal documentation from my parents’ attorney

- coordination with my sister

- navigating confusing instructions under financial and emotional strain

This was happening while:

- savings were already depleted

- employment had been lost earlier

- caregiving responsibilities had only recently ended

The process did not feel designed to help families remain housed.

It felt designed to filter them out.

The Hidden Contradiction

Here is the contradiction no one wants to name:

We encourage family caregiving.

We discourage institutionalization.

We praise responsibility.

Then we penalize it financially.

When families do the hard work privately, the system steps back.

When the parent dies, the system steps in—with its hand out.

Caregiving saves public resources.

Yet caregivers absorb the cost.

What Was Actually at Stake

This was not about market speculation or profit.

It was about:

- whether a family could remain in a lifelong home

- whether continuity mattered more than revenue

- whether planning ahead actually protected anyone

The house was not extravagant.

The increase was.

And it came at precisely the moment of maximum vulnerability.

How This Happens to Others

This story is not unusual.

It affects:

- adult children caring for aging parents

- middle-class families in long-held homes

- people approaching retirement with limited flexibility

The mechanics vary, but the result is often the same:

sell, move, or collapse financially.

Grief becomes leverage.

When Policy Ignores Human Timing

Death does not arrive on a fiscal calendar.

Families do not grieve on a deadline.

Caregivers do not rebound instantly into higher income.

Yet the system treats these moments as administrative events—detached from human reality.

What is framed as neutral policy becomes deeply personal in execution.

A Question Worth Asking

If families plan responsibly, care sacrificially, and try to preserve continuity—

why does the system make staying so difficult at the very moment they are least able to absorb the shock?

And what does that say about whose interests are truly being served?

Next in this series:

No-Fault, No Justice: How Family Courts Transfer Wealth From the Faithful to the Destructive

Newsletter

Please sign up for my newsletter if you wish to be updated!

Thanks!